While it seems safe to assume that the design of U.S. homes will undergo fairly significant changes over the coming decade, it’s equally likely that these changes will be determined by fundamental economic and demographic developments instead of Jetsons-style technological innovations. The aging of our population, the continued recovery from last decade’s housing collapse, and a painfully slow economic recovery that is making it difficult for younger households to get ahead in the housing market are all factors that will shape the future of home design.

In the AIA’s Home Design Trends Survey, leading residential architecture firms provided their vision for the next 10 years in terms of home layout; features, systems, and products; neighborhood and community design; and kitchens and baths. The key trends that they identified are the growing popularity of universal design; increased attention to a healthy living environment; infill development and its focus on improved design; and the growing popularity of kitchens as the focus of household activities.

Housing Progress and the Housing Bust

The AIA has been tracking home design trends since 2005 through quarterly surveys of approximately 500 residential architecture firms. Since that inaugural year was near to the peak of the last housing boom, this survey has traced the housing market from one of the strongest booms through the steepest housing downturn since the Great Depression of the 1930s. Through this decade of transition, several home design themes emerged.

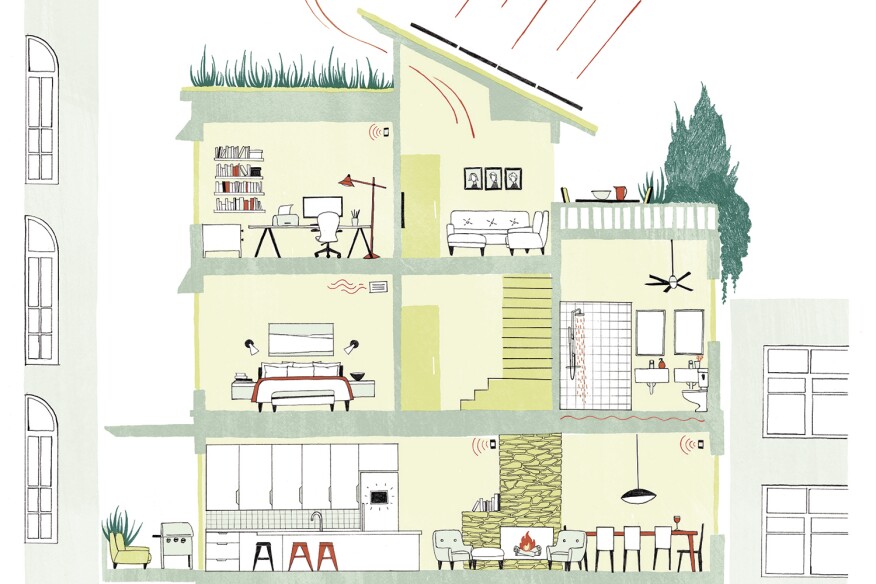

• Outdoor living expanded in popularity. Lifestyles have become more informal, and homes are reflecting this. Formal living rooms and dining rooms are disappearing, replaced by great rooms, dens, and open-space layouts. With this movement to informality has been growth in outdoor living. While initially decks, patios, and outdoor grills were the focus, this trend has expanded to outdoor kitchens and even fully furnished outdoor rooms.

• Changing work patterns encouraged growth of home offices. During the recession, company scale-backs forced many to work or job hunt out of their homes. Additionally, technology advancements made telecommuting a more feasible option for many workers. As a result, even though homes were getting smaller during the housing downturn, home offices were growing in popularity.

• Residential projects were integrated into mixed-use facilities. With the downturn came the demise of large suburban tract housing developments. In their place, housing activity occurred in smaller projects, often tied to other commercial activities. This approach often necessitated higher-density development and provided additional amenities for nearby residents.

• Technology was incorporated into kitchens and baths. The Great Recession coincided with a period of technological innovation. Many consumers supplemented their traditional desktop computer with laptops, tablets, and smartphones. This created the need to provide the infrastructure within homes to support all these devices. Additionally, growing concerns about sustainability increased consumer demand for energy and water conservation devices, and emerging technologies often facilitated the management of these systems in the home.

Forces Shaping the Coming Decade

While economic cycles will, hopefully, be a good deal less severe over the coming decade, several demographic forces will shape housing demand in the years ahead. The first of these is the general aging of our population and, more specifically, the movement of the Baby Boom generation into their retirement years. Though population growth will slow in the coming years, the share of people 65 or older will grow dramatically, relative to current numbers, accounting for about two-thirds of net population growth in the coming decade.

Gen Xers, defined by some experts as those currently between the ages of 31 and 50 (and others as those between 35 and 50), are a key demographic for the future health of the housing market. This group was also the hardest hit by the housing recession, often because they were just entering into homeownership as the market collapsed. While the national homeownership rate declined from 69 percent to less than 64 percent over the past decade, rates fell at about twice that pace for Gen Xer households.

Still, most of the concern over future housing market conditions is focused on the Millennial generation, the largest generation in U.S. history. The weak economy has had the greatest effect on this generation in terms of delays in forming independent households, getting married or forming partnerships, and having children. This has limited the need for additional homes and skewed demand toward renting for those Millennial households that have been formed.

Generational patterns aside, the overall slowdown in population growth is reducing the need for new homes. As such, a greater share of residential investment in coming years will be devoted to improving existing homes rather than building new ones. Over the past few decades, about 60 percent of housing spending has been devoted to building new homes as opposed to maintaining and improving the existing housing stock. That share is shifting, and within a decade we should see that ratio flipped with 60 percent of expenditures devoted to the existing housing stock.

Emerging Influences on Home Design

A recovering housing market, coupled with evolving demographic patterns nationally, will largely determine emerging home design trends through 2025. Identified by leading architecture firms in our survey, some of these trends are already in place and will continue to develop while others are still in the early stages of adoption.

• Continued expansion of universal design and accessibility features throughout the home. Universal design, a series of principles that encourage a more accessible environment, has been well-articulated for two decades. However, we now have a large generation of households that is beginning to think more seriously about its housing needs for the coming years. Over the next 10 years, the majority of Baby Boomers will have turned 65; those households that remain actively involved in home improvement projects will increasingly think about how to incorporate accessibility features into the projects they undertake.

• Increased focus on a healthy home environment. The emerging concern over environmental health issues is increasingly being focused on residential environments. A recent national consumer survey found that a quarter of homeowners were at least suspicious that their home may be causing health problems, while an additional 20 percent were unsure whether to be concerned or not. Since renters have less ability to control their residential environment, they express even higher levels of concern. Indoor air quality tops the list of healthy home concerns, but water quality and potentially harmful materials or chemicals in the home also are commonly mentioned. Greater consumer awareness and growing mistrust of government and industry are likely to push healthy home issues to even greater levels of awareness.

• Infill development promotes smaller, better designed homes. Building in established locations that are more accessible to jobs, public transportation options, and commercial activities has increased as many younger households show little interest in traditional housing subdivisions in more remote locations. Building in these more accessible locations is typically more expensive, so homes frequently are smaller and have more innovative designs. Residential architects feel that this trend will continue. Smaller households may have less interest in larger homes, and may instead look for more desirable locations with more personalized design features.

• Kitchens remain a focus of household activities. Even during the housing downturn, as households scaled back many home features, few residential architects reported less attention to size and features of kitchens. Kitchens have evolved into the family center of most homes, and, as the housing market recovers, residential architects report even more emphasis on this. Because family space connected to kitchen space has become standard in most new homes, the centrality of the kitchen to household operations is destined to continue to increase.

Obviously, other factors will have a major influence on how homes are designed over the coming decade. New technological breakthroughs, evolving building code and regulatory issues, and changing consumer preferences for housing features and materials are obvious considerations that will influence home design. Still, residential architects see that changes in design features are incremental, and generally reflective of underlying social and economic trends.

Beyond Your Front Door

Nonresidential buildings are expected to reflect similar changes to homes over the coming decade. The members of the AIA’s Work-on-the-Boards panel provide their perspective on how buildings might evolve.

Technology enhancements increase efficiency. Fifty-nine percent of architects currently use natural ventilation in their projects, with 75 percent expecting to do so by 2016. (The Drive Towards Healthier Buildings McGraw- Hill Construction SmartMarket Report, 2014)

Emerging technologies continue to be increasingly important in design and construction. New technologies not only make buildings more efficient, but can also increase the efficiency of the people using the buildings. Architects anticipate that there will be a significant increase in the importance of lighting technology systems (e.g., LED) over the next five to 10 years. These changes not only contribute to the increased energy efficiency of buildings by decreasing the use of electricity, but also enhance the workplace environment for the people working there through more natural light. In addition, 41 percent of survey respondents anticipate a significant increase in the importance of automated systems, which can also help decrease energy usage through products like motion-sensor-activated lights.

Heightened focus on conservation. Sixty percent of architecture firms anticipate that water efficiency will be one of the top client sustainability priorities in the coming decade. (April 2015 Architecture Billings Index special question)

Along with reductions in energy usage through the use of new technology, conservation of other natural resources is expected to increase in the design and construction industry in the future. Four in 10 responding architecture firms expect that water conservation will significantly increase in importance over the next five to 10 years, while 38 percent of firms anticipate that energy efficiency designs and retrofits will do the same. In fact, in some jurisdictions, codes governing many of these issues already exist. Solar and wind power are also expected to increase in importance for building design over the next decade.

New design and construction methods change the building process. Thirty-seven percent of architecture firms used BIM for billable work in 2013, up from 10 percent in 2005. (2014 Firm Survey)

The tools and methods that architects use to design buildings are also continuing to evolve. The use of building information modeling software, while already widespread, will continue to grow over the next decade. In addition, 22 percent of responding firms expect that design/build and other alternative project delivery techniques will significantly increase in importance, as will lean construction techniques. These trends speak to increased efficiency in both the building design process as well as throughout the life cycle of the building.

Innovation in materials allows for expanded design options. From 5.5 to 8 percent of total annual U.S. energy consumption is from building construction and materials. (2030 Challenge for Products)

In the future, efficiency will not only be found in the design of buildings but also in the products that are used in the construction of those buildings. Technology has led to the development of products that not only contribute towards increasing building efficiency (e.g. renewable and low-maintenance materials)—which 28 percent of responding firms anticipate will significantly increase in importance over the next five to 10 years, but products that also allow for new ways to design, such as through composite materials and new glass and glazing technologies.